Watch: Hapco's "Bridge the Gap" Elected Officials Panel Discussion

Watch: Hapco's "Bridge the Gap" Elected Officials Panel Discussion

On Thursday, September 19, 2024, Hapco Philadelphia sponsored a panel discussion at St. Joseph’s University entitled “Bridge the Gap”. Philadelphia rental property owners listened as three city and state elected officials discussed housing topics including affordability, rent control, eviction, city services, taxes, squatters and more. Watch the full discussion here.

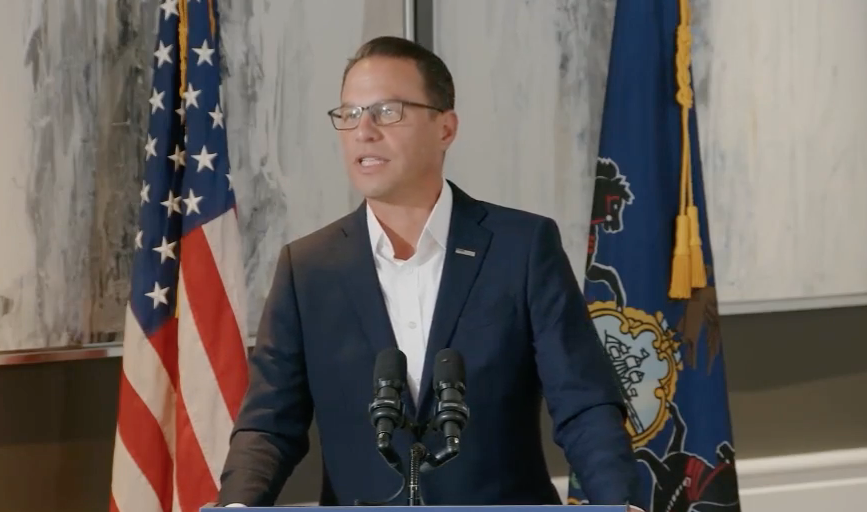

Watch: Governor Announces New PA Housing Initiative

"Bridge the Gap": Hear from our elected officials on September 19th

Elected official confront real estate challenges in Philadelphia. Join us on September 19, 2024 from 5:30 – 8pm at the Saint Joseph’s University Mandeville Teletorium. Speakers include Philadelphia City Councilmembers Rue Landau and Jamie Gauthier, State Rep. Morgan Cephas and Senator Nikil Saval. The event is free to both Hapco Philadelphia members and non-members. Refreshments will be provided. Register at hapcophiladephia.com.