While Philadelphia may be Top 20 for new apartment construction in RentCafe’s new study, the big question Hapco Philadelphia has is how much of that rental housing is affordable, and how much is market rate?

The apartment construction boom during the pandemic years brought a whopping 1.2 million new apartments to the market. This trend is set to continue into 2023, as 460,860 more rentals are expected to be completed by December. And here’s the exciting part: the apartment market will keep growing in the coming years, with an additional 1 million rentals projected for completion by 2025, according to our report.

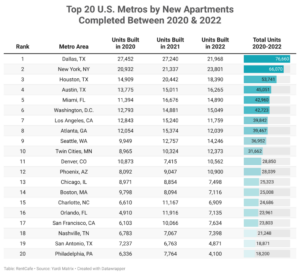

Philadelphia metro emerged as a prominent contributor to the pandemic building boom, having constructed a total of 18,200 units, ranking 20th among the metros analyzed. Furthermore, Philadelphia proper is expected to add an additional 2,950 new apartments by the end of this year.

Here’s an overview of the current and upcoming apartment construction projects in the Philadelphia metro area:

-

At the city level, Philadelphia led the metro with an impressive 6,852 new units added to the market between 2020 and 2022 – almost 1,500 units more than Boston.

-

Nearby Exton came in second with 1,045 units added to the market during those three years, followed by Wilmington with 937 units.

-

Nationwide, Dallas metro is the torchbearer in apartment construction between 2020 and 2022, having completed an impressive total of 76,660 units. However, New York has the highest number of apartments projected for 2023, with 33,000 units expected to open by the end of the year, followed closely by Dallas and Austin, Texas’ heavy builders.

-

Despite its recent boom, the U.S. apartment construction market is poised to face challenges in the coming years. New completions are expected to decrease by 15% year-over-year, dropping from 484,000 in 2024 to 408,000 in 2025, then hitting a low point of approximately 400,000 units in 2026.

The supply growth is likely to go slower after the current round of projects is completed.

“Tightening of bank lending standards — combined with rising costs of construction materials, labor and land — has made new projects harder to pencil,” said Doug Ressler, manager of business intelligence at Yardi Matrix.