Philly Still Hot For Renters Seeking Winter Deals, Survey Says

Hapco Philadelphia’s friends at RentCafe.com are still seeing Philadelphia as among the most sought-after places for renters in January, ranking 49th nationwide. The increased rental activity in the city led to a significant drop in available listings on RentCafe.com.

In this year’s first rental activity report, they highlight the U.S. cities that attracted the most attention from apartment hunters seeking the best winter deals. To compile this report, RentCafe analyzed website traffic data for listings in the 150 largest U.S. cities, shedding light on renters’ intent and preferences.

Here are the metrics that contributed to Philadelphia’s January ranking:

- Views of Philadelphia listings on RentCafe.com have increased by 71% compared to last January, indicating a growing interest in the city’s offerings. Most prospective renters interested in Philadelphia, besides locals, are from New York.

- Apartment hunters saved 5% more personalized searches for apartments, despite the fact that there were 17% fewer listings available for apartment hunters compared to 2023 due to high rental demand.

- In the Northeast, Philadelphia is the 5th city attracting the most interest from apartment seekers, sandwiched between Boston and Manhattan.

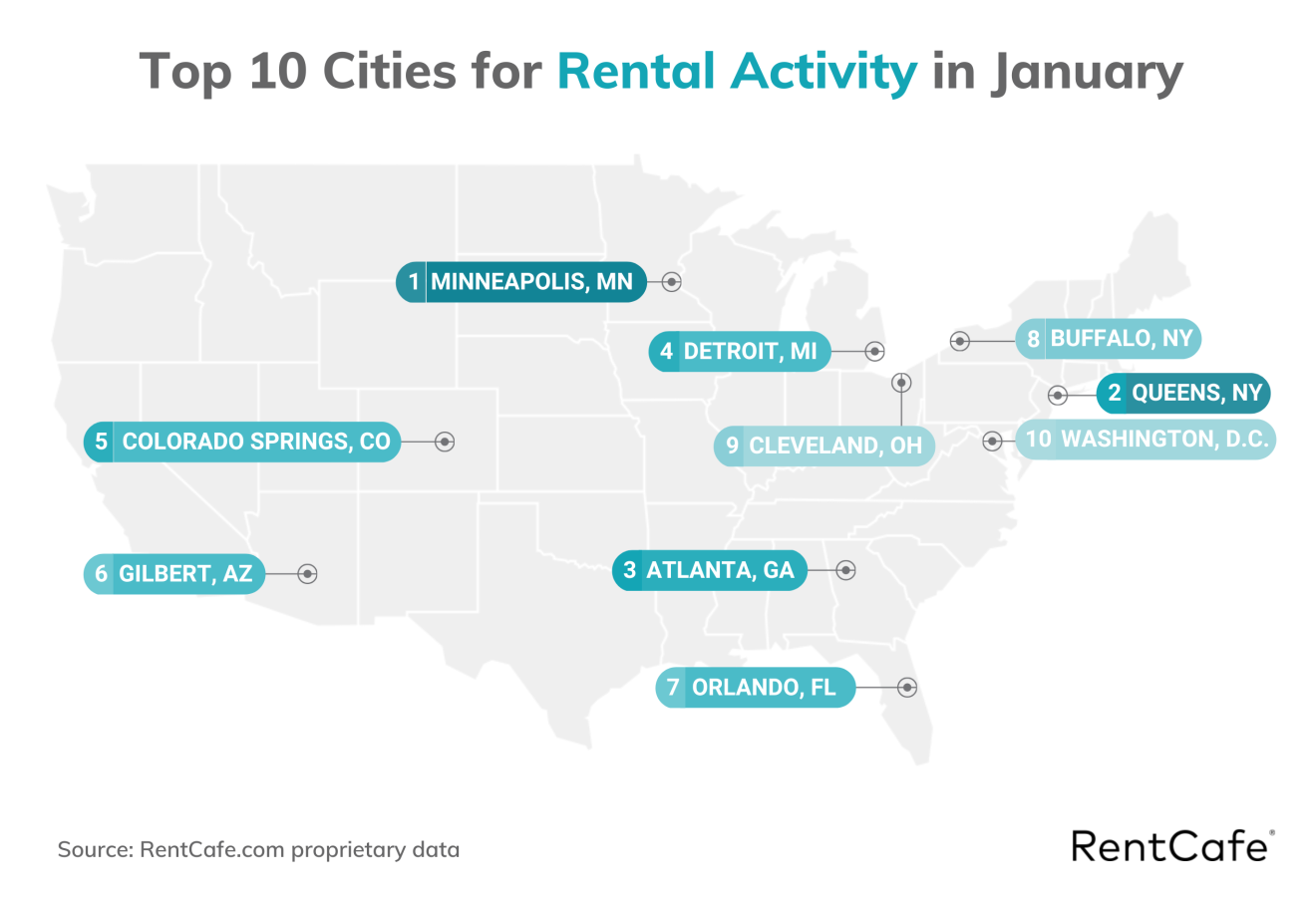

- The bigger picture: Minneapolis is January’s most coveted city among renters. When it comes to the most popular region for renters, the West leads with 11 cities in our top 30, the Midwest follows with nine cities, and the South is represented by seven entries.

Don’t miss: Philadelphia expected to see nearly 1,000 office-to-apartment conversions, up by 136% YoY. Philly is 14th on the list of U.S. locations with the highest conversion numbers, according to our report.

And here's some extra real estate resources and information on Philadelphia's place in the rental world:

- The average rent in Philadelphia is $1,887.

- About 29% of apartment rents in Philadelphia range between $1,501-$2,000. Meanwhile, apartments priced over $2,000 represent 31% of apartments.

Don’t miss: Philadelphia expected to see nearly 1,000 office-to-apartment conversions, up by 136% YoY. Philly is 14th on the list of U.S. locations with the highest conversion numbers, according to RentCafe's recent report.

Mayor Proposes Improving L & I. It Can't Get Any Worse

With a shortage of inspectors and massive case loads for those few inspectors they do have, Philadelphia Mayor Cherelle Parker proposes splitting L & I into two divisions.

One would target inspections, safety, and compliance. The second would focus on “quality-of-life” issues and business code enforcement.

Creating more bureaucracy isn’t necessarily a good thing, but Hapco Philadelphia feels in this case, it can’t hurt.

Get The Latest Intel From Hapco Philadelphia's Watchdog In Harrisburg

Philly's Affordable Rental Housing Shortage Mirrors Nationwide Shortfall

Dropping Mortgage Rates, Construction Declines, & Baby Boomers In The Real Estate Newsletter

Philly Ranks 14th In Nation In New Office-to-Apartment Conversions

Hapco Philadelphia predicted that those emptying office spaces in Center City would be prime real estate for apartment conversions.

Well, it’s happening according to a survey from our partners at RentCafe.

Your former workspace could become your newest rental. The Philadelphia metro is experiencing a surge in office-to-apartment conversions, with nearly 1,000 units in the pipeline. The Philly metro is 14th on the list of areas with the most office conversions underway in 2024.

Nationwide, 2024 is a record year for repurposed office spaces, with 55,339 units currently under conversion and expected to enter the market in the coming years. That said, office conversions account for 38% of the 147,000 apartments anticipated to result from adaptive reuse projects in the U.S.

Here are more key highlights for Philly:

- The Philadelphia metro is converting 975 units from office spaces, representing 19% of the area‘s total future conversions (5,092).

- Compared to last year, the number of office-to-apartment transformations has more than doubled, increasing by 136%.

- The 1701 Market Street project is at the forefront of adaptive reuse in Philly, aiming to repurpose an office building into 325 new apartments.

- The bigger picture: From 2021 to 2024, the number of apartments scheduled for conversion from old office spaces increased from 12,100 to 55,300 nationwide. This trend is most prominent in Washington, D.C. (5,820 units), followed by New York (5,215 units), and Dallas (3,163 units).